- Protected Saturdays

- Posts

- OfficeHours is hiring PE Associates for Periscope Equity

OfficeHours is hiring PE Associates for Periscope Equity

Over 300 Applications Received in 4 Days!

Join us tomorrow to learn more about the Periscope Equity process and hear from four individuals that have worked within Growth Equity/Private Equity discuss interviewing and hiring for the Buyside!

“Chicago – December 15, 2020. Periscope Equity (“Periscope”), announced the final closing of its second institutional fund, Periscope Equity II, L.P. (“Fund II” or the “Fund”) with $225 million of capital commitments. The Fund exceeded its target and was oversubscribed with the backing of an experienced group of limited partners, including university endowments, pension funds, charitable foundations, funds-of-funds and family offices. Periscope completed the fundraise of its inaugural fund in 2018 with $104 million of capital commitments.

“The durability and growth of our existing portfolio during the pandemic demonstrates the benefits of our consistent investment strategy, as we have never wavered from targeting companies with mission-critical offerings, a history of sustainable profitability, and a stable base of recurring revenue,” said Steve Jarmel, Founder and Partner.

“With Fund I nearly deployed in less than three years, we are thrilled to continue on our growth path and to execute our strategy of partnering with innovative, entrepreneurial companies on a larger scale,” said John Findlay, Partner.

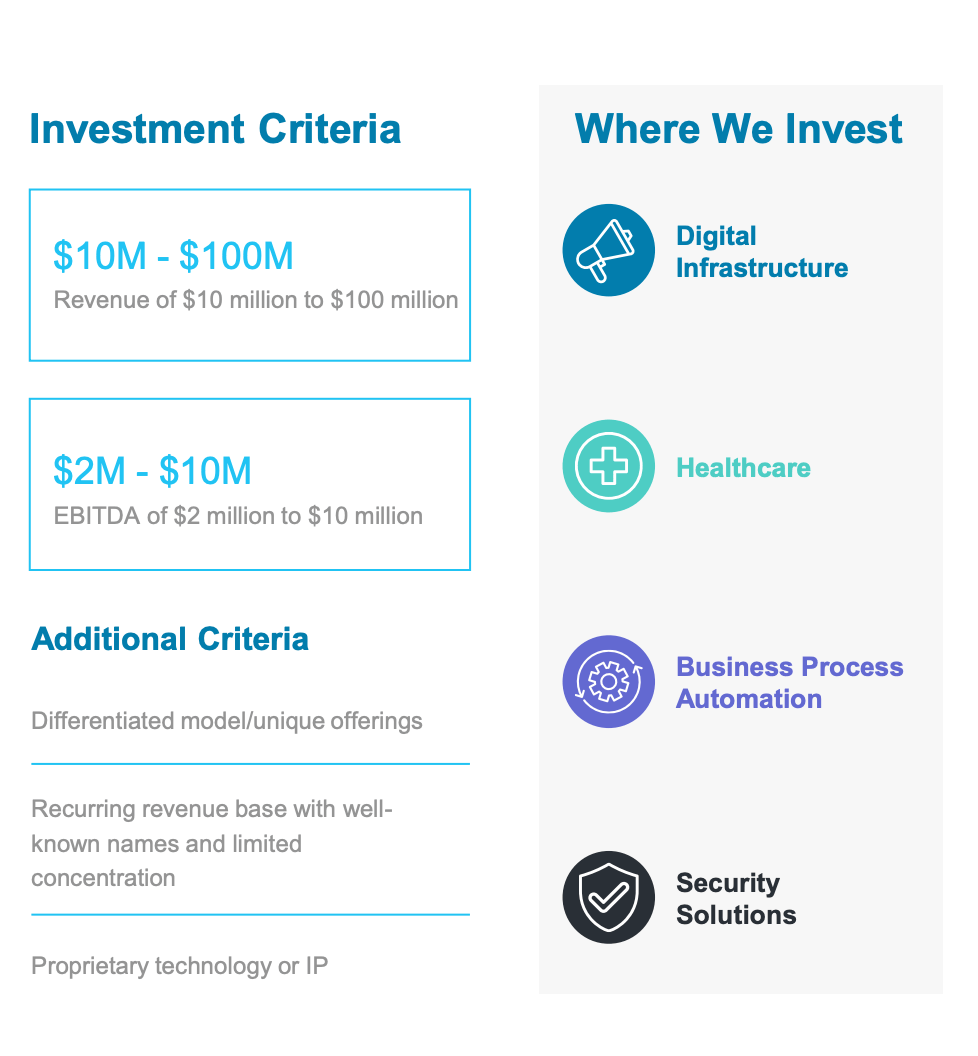

Fund II will continue to execute on Periscope’s investment strategy of control buyouts of founder-owned technology-enabled services and software companies across digital marketing, business process automation, security solutions, and healthcare technology. Since inception, Periscope has completed seven platform investments, three of which have been successfully exited, and 17 add-on acquisitions.”

We will not only be hosting the team from Periscope Equity (MM PE firm in Chicago) on our webinar TOMORROW but also will be helping them hire potentially MULTIPLE PE Associates for their Chicago office.

Join us as Joe McIlhattan, VP and Harry Waddoups, Associate discuss how they work together to find success in MM Private Equity.

🗓️ Date: Tomorrow - Thursday, August 31st

🕛 Time: 12:00 pm ET

Joe McIlhattan joined Periscope Equity in 2019 and is a Vice President. Periscope Equity is a Chicago-based private equity firm that partners exclusively with founder owned companies in the technology-enabled business services and technology-enabled healthcare services sectors. Periscope is currently hiring new associates for its team. Joe is responsible for deal execution, monitoring existing investments and overseeing the development and implementation of value creation strategies. Joe currently serves on the boards of Praecipio, WPAS, MAS, and as a board observer on Uprise Health.

Before joining Periscope Equity, Joe was an Associate at SFW Capital Partners, a middle-market private equity firm, where he was primarily focused on making control investments into analytical technologies, software, and services businesses. Additionally, Joe was a management consultant at EY where he developed growth and transformation strategies for clients across various sectors. Joe received a BA in Economics from Georgetown University and an MBA from The University of Chicago Booth School of Business.

Let’s learn more about Periscope Equity

Harry Waddoups joined Periscope in 2022 and is an Associate. He is responsible for identifying and executing new portfolio company transactions as well as supporting existing portfolio companies. At Periscope, he supports the Praecipio and Uprise Health portfolio companies, where he works directly with Joe. Prior to joining Periscope, Harry worked as an analyst for Raymond James' Technology and Services Group, where he concentrated on mergers and acquisitions in the software industry.

Harry is a former OfficeHours Mentee as well! We worked with him to prepare for interviews as he was preparing for various Buyside roles…

Harry graduated from Brigham Young University with a BS in Finance.

The moderators will be our Co-Founders, Asif Rahman, former PE/VC and IB and Rohit Malrani, formerly with SourceScrub and Battery Ventures.

The exciting thing about Periscope is that even though they’re a rather newer firm, they have already had a couple solid exits… when you’re joining a firm you have to think about timeline, carry potential, are they raising bigger funds and Periscope points to a green light regarding all of those.

Webinar Highlights:

Could you briefly describe your background and give an overview of your current roles?

Why did you decide to work in private equity? Why did you select MM Private Equity/Periscope?

What qualifications or experiences do you think were essential for you to land your jobs in MM Private Equity?

What are current trends in the PE industry that aspiring professionals should be aware of?

What sets MM Private Equity apart from more upstream or downstream firms (Megafund, UMM, LMM, growth, etc)?

Are there any specific steps or strategies that you recommend for building a successful career in this competitive field?

What do you think are the most important factors that contribute to your success working together?

Could you share some challenges you've faced in your roles and how you've overcome them? What have been the most rewarding aspects of your work?

Any final thoughts or advice you'd like to share with the webinar participants, especially those who are eager to pursue a career in private equity?

🎤 Featured Speaker 1: Joe McIlhattan

🎙️ Recent Position: Vice President, Periscope Equity

🎤 Featured Speaker 2: Harry Waddoups

🎙️ Recent Position: Associate, Periscope Equity, Former OfficeHours Mentee

The moderators will be our Co-Founders, Asif Rahman, former PE/VC and IB and Rohit Malrani, formerly with SourceScrub and Battery Ventures.

🎤 Moderators: Rohit Malrani and Asif Rahman

🎙️ Position: Co-Founders, OfficeHours, ex-IB/PE/Operating Experience

Are you interested in being considered for a PE Associate Role at Periscope? |

Do you currently live in/willing to relocate to Chicago? |

Check Out Some of our other PE Resources

Are you interested in learning more about OfficeHours and how a Banking/Buyside Coach can help you? |

What makes you most nervous for recruiting? |

Visit the OfficeHours Blog and follow us on our social media accounts: Instagram, LinkedIn, YouTube, TikTok, and Twitter for our latest updates.